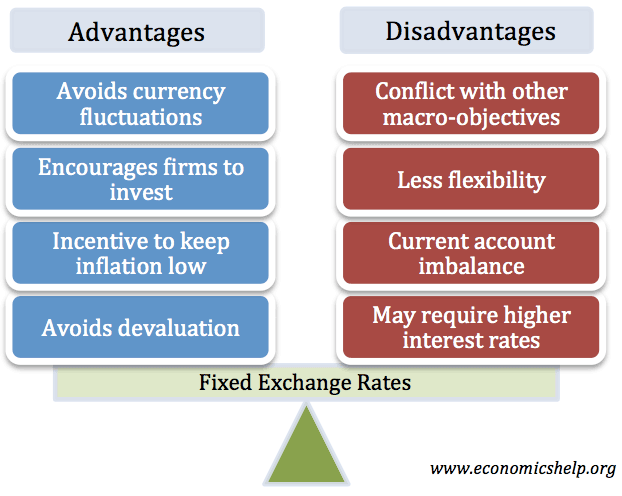

Advantages of Fixed Exchange Rate System

Especially in todays. It must be the same size for both parties.

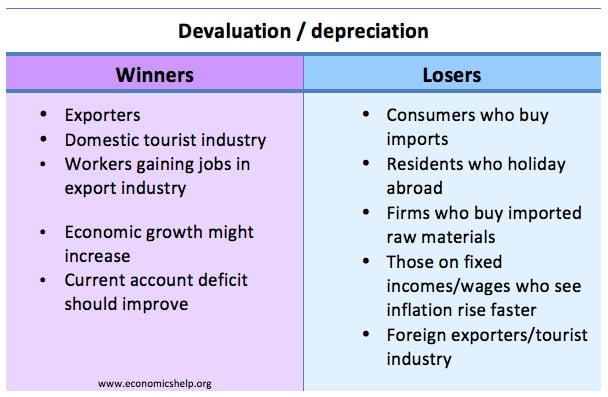

Understanding Exchange Rates Economics Help

An interest-only loan payment is based on both the interest rate and the balance so it can be variable.

. It keeps the yuan in a tight 2 trading range around that value. The receiver or seller swaps the adjustable-rate payments. Before repealing the fixed-rate scheme in 2010 Chinese foreign exchange reserves grew significantly each year in order to maintain the US.

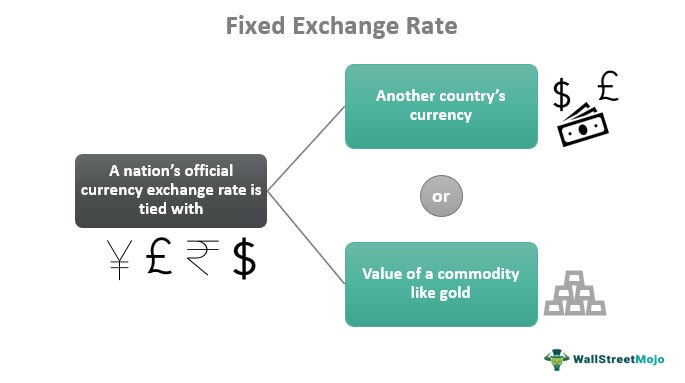

Later in 1980 the International Financial Architecture was regulated by G-5 countries. A fixed or pegged rate is a rate the government central bank sets and maintains as the official exchange rate. A fixed exchange rate means that you will always get the same value for your money in the base currency and will be given the same exchange rate every time.

For the authorities to manage the large international capital flows associated with maintaining a fixed exchange rate and consequently the difficulty in controlling domestic monetary conditions Debelle and Plumb 2006. How these could have been dealt with under a system of fixed exchange rate is not yet clear. Managed Float System has been in place since 1976 with the Jamaica Agreement.

Even though before deploying an IPsec based VPN its worth taking a look at its advantages and disadvantages. With proper care see below. We are revolutionizing the cloud computing industry by giving the power back to the end user.

The decentralized design provides many advantages. There are three main advantages of having a floating exchange rate. In 1974 the Australian dollar was pegged against the TWI and in.

Having a fixed exchange rate can give the currency a kind of stability and make financial transactions more consistent and manageable. Changes in world trade since the first oil crisis of 1973 have caused great changes in the values of currencies. Most tenors are from one to several years.

A key difference between a conventional fixed and interest-only loans. The reasons to peg a currency are linked to stability. Advantages of Current International Monetary System.

When you buy a bond you are lending to the issuer which may be a government municipality or corporation. In return the issuer promises to pay you a specified rate of interest during the life of the bond and. Success rates of dental implants vary depending on where in the jaw the implants are placed but in general dental implants have a success rate of up to 98.

This policy objective requires the conventional objectives of a central bank to be subordinated to the exchange rate target. Payments on a conventional loan is the same every month but the amount of interest you pay gradually falls and the principal portion increases as the loan is paid down. A bond is a debt security similar to an IOU.

However availability is challenging. This G-5 group has currently turned into G-20 with a group of 20 countries managing the exchange rate on managed float system. In August 2015 it allowed the fixed rate to vary according to the prior days closing rate.

However this means that your currency is affected by. Thats why it became our challenge to support the adaptation and development of decentralized applications that run seamlessly and provide continuous availability. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time.

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of goldThe gold standard was the basis for the international monetary system from the 1870s to the early 1920s and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold. It ties the value of its currency the yuan to a basket of currencies that includes the dollar. As a result it has no impact on higher.

A currency board is a monetary authority which is required to maintain a fixed exchange rate with a foreign currency. The payer swaps the fixed-rate payments. The pace of growth in reserves was so.

One country that is loosening its fixed exchange rate is China. In colonial administration currency boards were popular because of the advantages of printing appropriate denominations for local conditions. IPSec operates at layer 3 the network layer.

John Beardshaw has argued that A floating exchange rate helps to insulate a country from inflation elsewhere. The notional principle is the value of the bond. The tenor is the length of the swap.

Now lets move on and discuss the typical advantages that our Support Engineers see for IPSec. They only exchange interest payments not the bond itself.

Fixed Exchange Rate Meaning Pros Cons Examples And More Financial Management Accounting Books Exchange Rate

Advantages Of Fixed Exchange Rates Economics Help

Debenture Example Angel Investors Accounting And Finance Business Basics

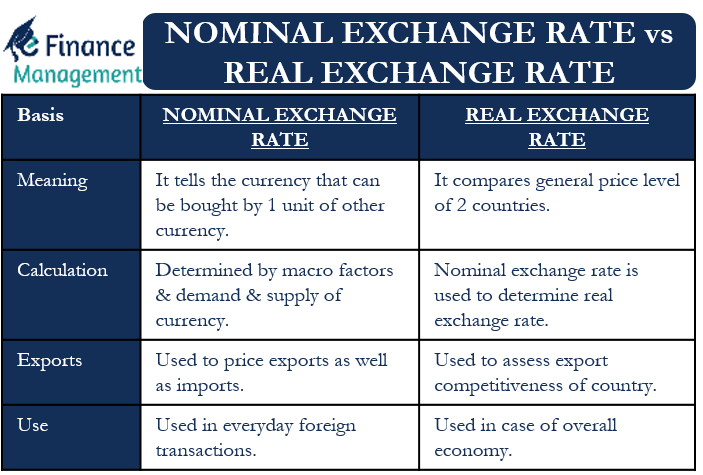

Real Vs Nominal Exchange Rate All You Need To Know

Fixed Exchange Rate Definition System Advantages

Different Exchange Rate Systems With Pros And Cons Https Www Bbalectures Com Different Exchange Rate Systems With Exchange Rate Forex Purchasing Power Parity

0 Response to "Advantages of Fixed Exchange Rate System"

Post a Comment